Nanex Research

Nanex ~ 25-Sep-2013 ~ Michigan Consumer Sentiment, Early Release

We reviewed 3 years of data for the market bellwether symbols SPY and IWM around the 9:55 time period on the days of the release of the Michigan Consumer Sentiment (MCS),

most of which fall on the 2nd and 4th Fridays of the month. The MCS is released at

10am Eastern Time to the general public, but Thomson Reuters (TR) delivers this number to two tiers of subscribers who pay a premium

to receive it earlier: at 9:55 for one group,

and 2 seconds earlier at 9:54:58 for the elite group.

The most important part of the MCS news release toWall Street is just one number, but

it is an extremely valuable number. It has value because of a long history providing the stock market an indication

of the direction of the economy. More importantly, it has value because the market believes

it has value, and significant trading activity is based on whether the number meets,

exceeds or falls short of the expected value.

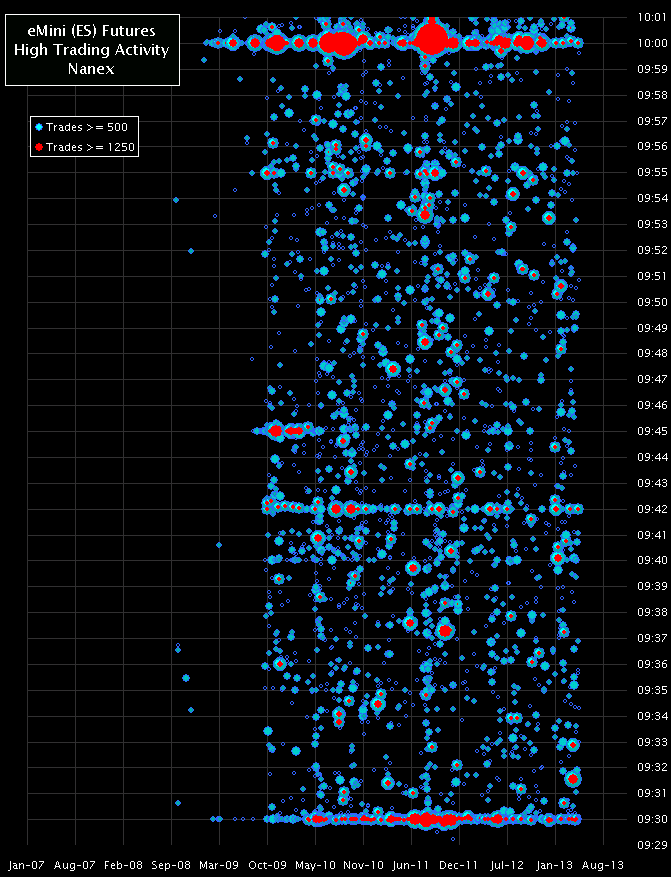

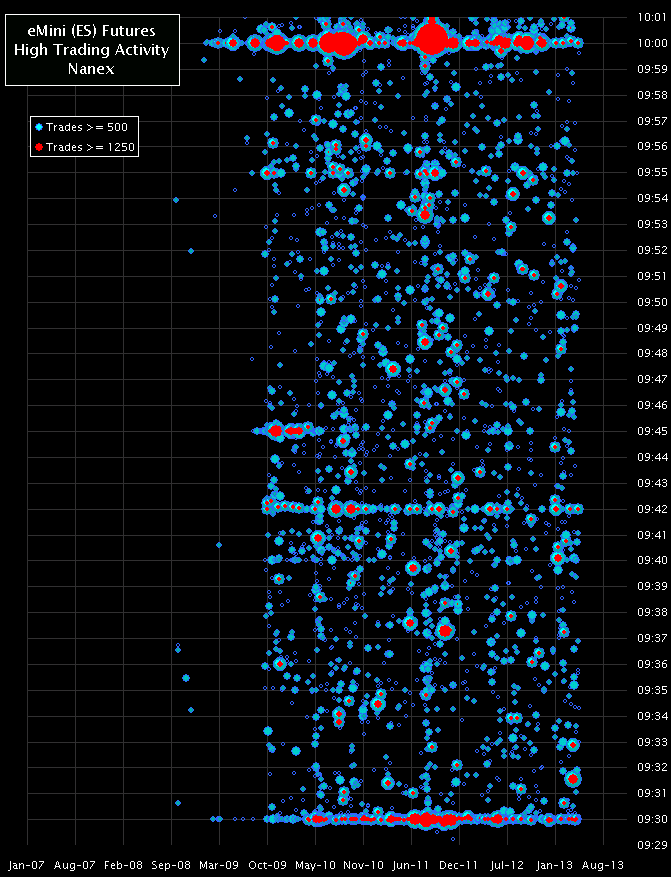

The activity resulting from the release of MCS can be so great, that it registers as

one of the most active trading seconds in the S&P 500 futures contract, as well

as many large, well known stocks and ETFs. The chart below shows the most active trading

seconds between 9:30 and 10:01 over more than 5 years of time. Note that many dots line

up around the 9:55 line. These are all the result of extreme market trading activity

from the release of the MCS number at 9:54:58 to the elite group of subscribers.

1. The most active seconds of trading between 2007 and July 2013 in the electronic

S&P 500 futures contract.

When we looked at individuals days (see charts below), and zoomed in on the trading

actitivy leading up to the release of the MCS number at 9:54:58, we noticed that on

some days, the market behaves as if the MCS number is already known. Sometimes this

show up as a surge in the seconds before 9:54:58 (December 7, 2012). It can also show

up when there is significant buying (trades at the best ask), but the price remains

firm: as if the market was capped, as someone is willing to sell to an eager buyer,

without raising the price, even right up to one second before this important number

is released (February 10, 2012). When looked at as a group, it becomes clear to us that

earlier market activity appears influenced by activity at the time the number is released

at 9:54:58. Since no one can see into the future, the only plausible explanation is

that the MCS number must be known to one or more stock market participants before the

9:54:58 scheduled release time.

2. Charts of IWM and SPY showing trades (dots color coded by exchange) and the

NBBO (National Best Bid Offer) shaded gray for 20 select days indicative of market

behavior that appears influenced by the MCS number not yet released.

Because the MCS "product" is a simple, yet extremely valuable number than can easily

be transmitted (either in the clear, encrypted, or even with a wink and a nod), we would

hope that extreme measures to protect it from early distribution were put in place.

Imagine our shock when shown email chains that treat this high value number with practically

no concern at all.

Our analysis of the email chains of parties receiving the valuable MCS number well before

the scheduled release time reveal:

- It looks like the number typically arrived between 9:00AM and 9:45AM (before the official announcement)

- The list of people on the distribution list looks to be internal Thompson Reuters employees. However, one individual wasn't able to be verified. More information can be provided on request.

- Two of these employees appear to be currently located in India. The rest appear to be located in NYC. So the data was possibly sent over the interent.

-

Given that it's sent over the internet it has a chance of being intercepted in transit because of the following two factors:

NOTE:without direct access to the original email including headers the following statements can't be completely verified from the PDF copies of the email

- It's not evident that the data was sent via an encrypted email channel, so it could possibly be intercepted in plain text while in transit.

- The messages don't appear to be digitally signed, so the origin of the email could have been spoofed or faked.

Nanex Research

Inquiries: pr@nanex.net