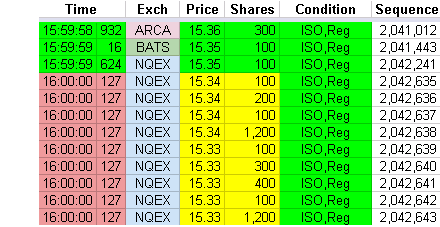

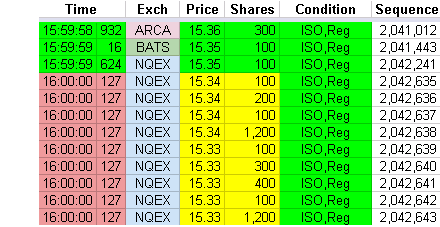

On February 20, 2014, in the stock of Acacia Research Corporation (symbol: ACTG,

market cap $730 Million), starting at 127 milliseconds after market closing time (16:00), a large burst of trades appeared from Nasdaq and ARCA,

sending the price down 3%, and setting the official close in the stock. The trades from

Nasdaq and ARCA were marked with a condition that indicated they were from the regular

trading session (9:30 - 16:00) and not the after hours session. After hours trades and

quotes from other exchanges rule out the possibility of a delay in the consolidated

feed which might cause these trades to appear late. We are confident they executed after 16:00.

Two other stocks had similar patterns - CENX and COMM, and also had earnings news. See

chart 3.

See this paper which details our

initial discovery of this anomaly that led to several WSJ articles,

eventually forcing

Business Wire to terminate a special direct earnings news service to High Frequency

Traders.

Download a list

(pdf) of the trades shown in the charts below. |

|