Nanex Research

Nanex ~ 28-Oct-2014 ~ Record Treasury Futures Trades

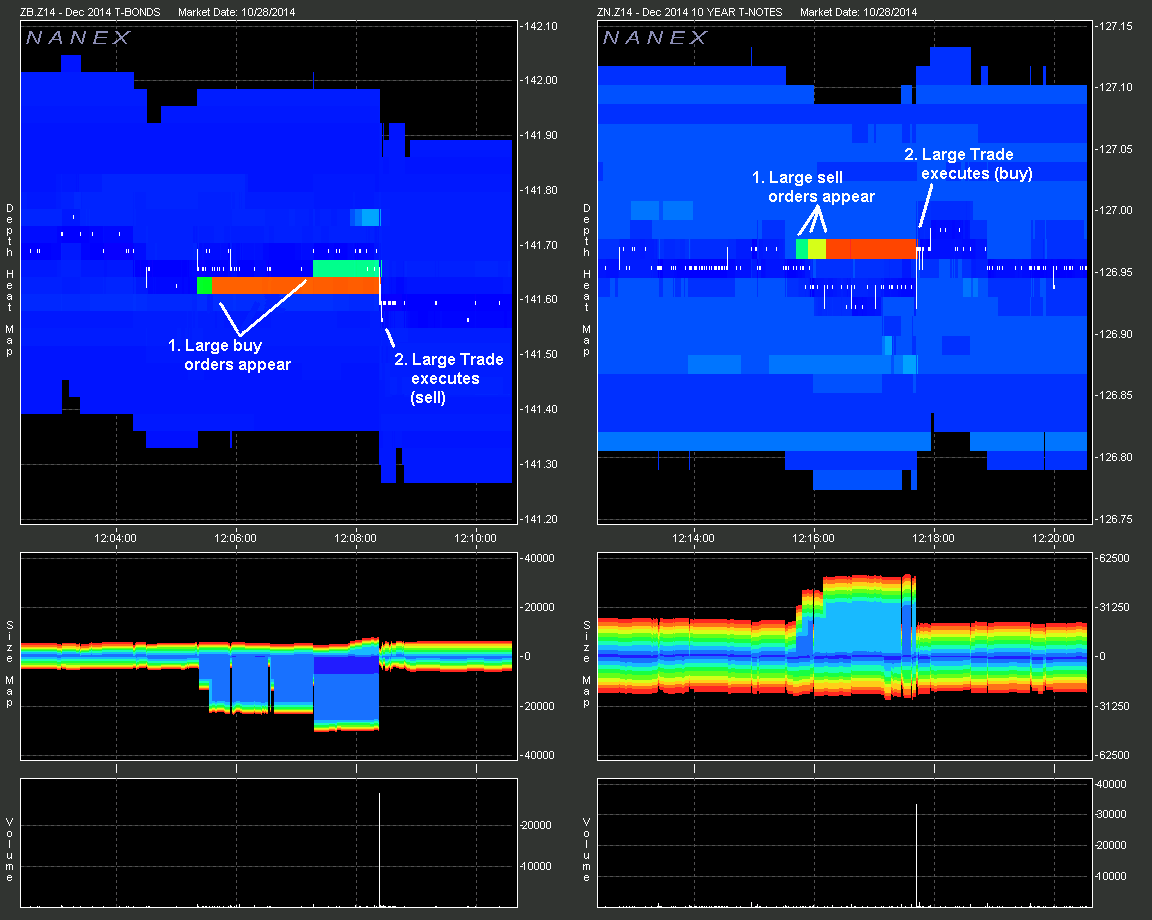

Monster buy in the 10-Year and sale in the 30-Year a day before FOMC

On October 28, 2014, there were two monster sized trades in Treasury Futures, a 26000+

contract trade (sale) in the 30-Year T-Bond (ZB) at 12:08:23 and a 29000+ contract

trade (buy) in the 10-Year T-Notes (ZN) at 12:17:42. We know the 10-Year trade set a

record for most contracts traded in 1 second for that contract since at least 2005 (the

30-Year may have as well, but we haven't completed a thorough check of the data).

What made this event even more interesting, was that an equivalent huge order in the

opposite direction first appeared 3 minutes before the trade in the 30-Year and exactly

2 minutes before the trade in the 10-Year. That is, buy orders totaling about 27000

contracts started appearing in 9000 contract lots at 12:05:21 in the 30-Year - which

were executed against by a large 26000+ contract sell order just over 3 minutes later, at 12:08:23. In the 10-Year, sell orders in lots of 9500 contracts started appearing

at 12:15:42 and were executed against exactly 2 minutes later at 12:17:42.

The two charts below show this sequence of events.

1. Depth of book for the 30-Year (ZB, left) and the 10-Year (ZN, right). (how to read these charts).

The white vertical lines in the middle of the top section are trades. There are 10 levels

of bids and 10 levels of offers - each color coded by how many contracts are available

to instantly buy or sell. The red indicates the highest relative to other levels. Most

of the levels are deep blue because they are practically empty, relatively speaking,

when compared to those huge orders in the top few levels.

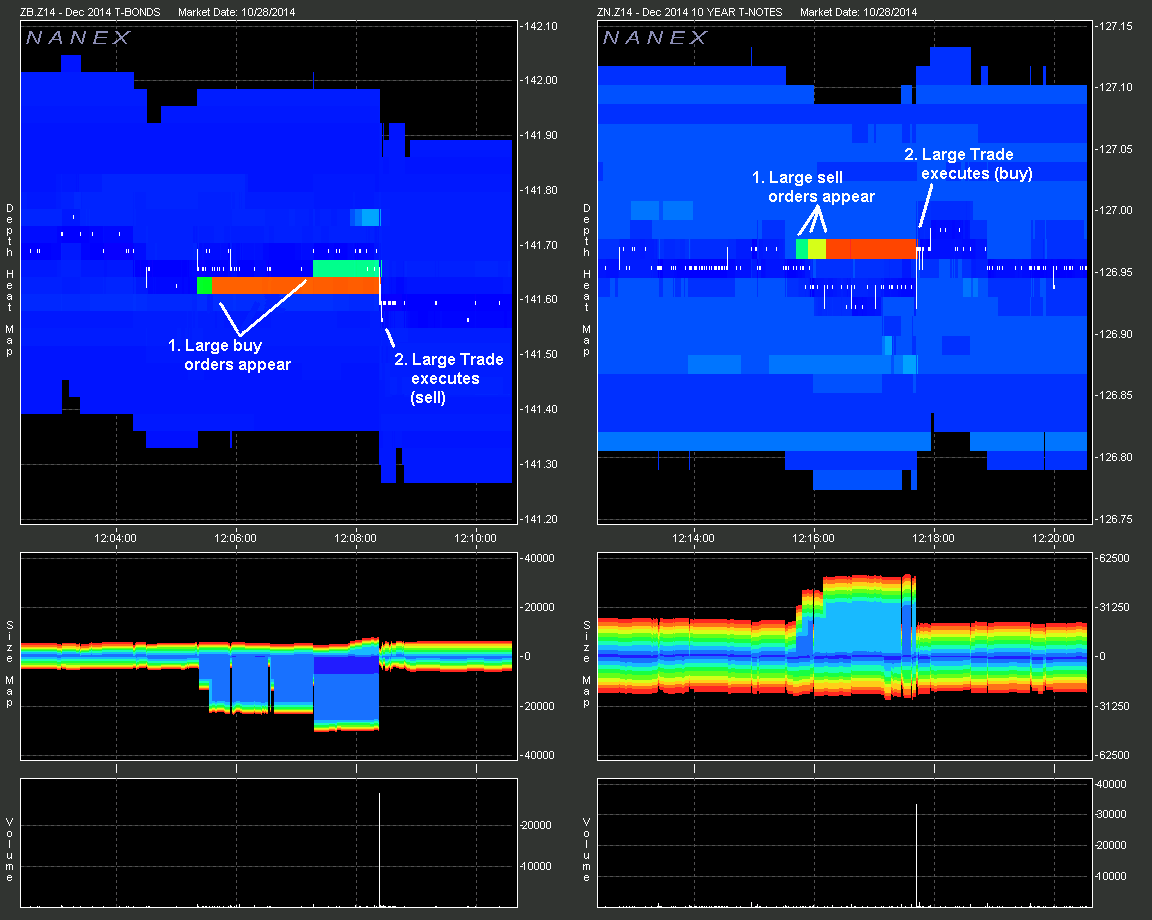

2. Chart of the most contracts offered for sale in the top 3 depth of book levels

for every second since 2008 in the 10-Year Treasury Contract (ZN).

Each day is drawn as one line from left (starting at midnight or 0:00) to right (and

ending at midnight 24:00). Days are color coded by age - with red being the most recent

and violet the oldest - with the exception of October 28, 2014 which is a thick purple

line for contrast. Since at least 2008, there has never been as many contracts for sale

in the top 3 levels of CME's depth of book for the 10-Year Treasury Contract.

3. Chart showing the most contracts traded in any one second for the 10-Year

Treasury Contract (ZN) since 2005.

Nanex Research

Inquiries: pr@nanex.net